发布时间:2019-05-28 来源于:广东广信君达律师事务所闪涛、曹杨欣柳

一、QFLP/ RQFLP 相关概念 / About QFLP and RQFLP

QFLP即合格境外有限合伙人(Qualified Foreign Limited Partner),是境外机构投资者在通过资格审批和其外汇资金(含跨境人民币)的监管程序后,将境外资本流入汇兑,投资于国内的PE(私募股权投资)以及VC(风险投资)市场。RQFLP是使用跨境人民币认购境内基金份额的合格境外有限合伙人。QFLP制度,相较于已经实行多年的QFII(合格境外机构投资者)制度而言,前者是针对股权投资,后者是针对证券投资,但都可视为在现行中国资本和金融项目未实现完全汇兑情况下外资以证券化方式投资中国市场的途径。

QFLP refers to Qualified Foreign Limited Partner (QFLP). QFLP is a Foreign institutional investor who, after qualification examination and approval and the regulatory procedures of its Foreign exchange funds (including cross-border RMB), flows Foreign capital into the Foreign exchange and invests in the domestic PE (private equity) and VC (venture capital) markets. RQFLP is a qualified foreign limited partner that uses cross-border renminbi to subscribe for domestic fund shares. Compared with the QFII (qualified foreign institutional investor) system which has been implemented for many years, the QFLP system is for equity investment and the QFLP system is for securities investment. However, both of them can be regarded as a way for foreign capital to invest in the Chinese market by means of securitization when the current Chinese capital and financial projects have not achieved complete exchange.

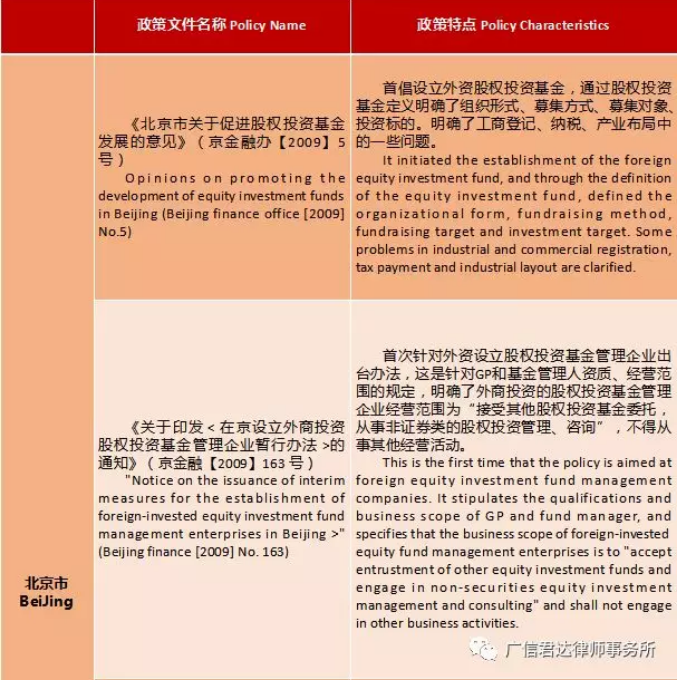

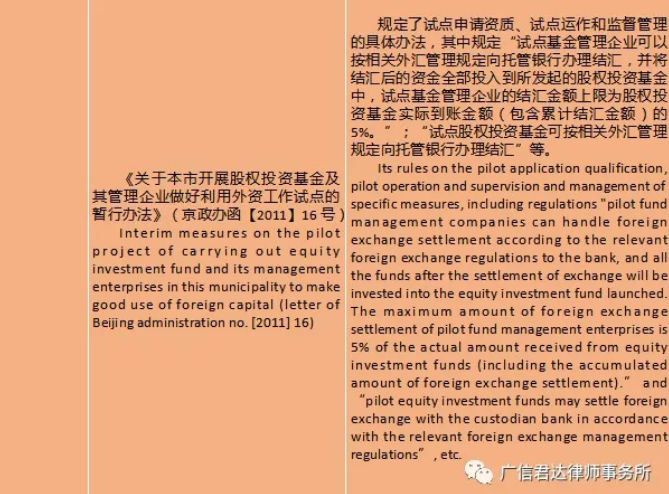

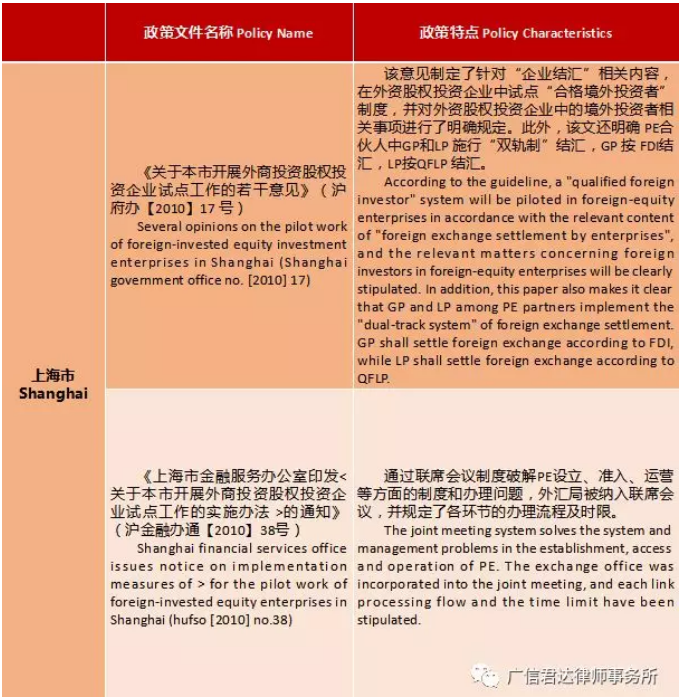

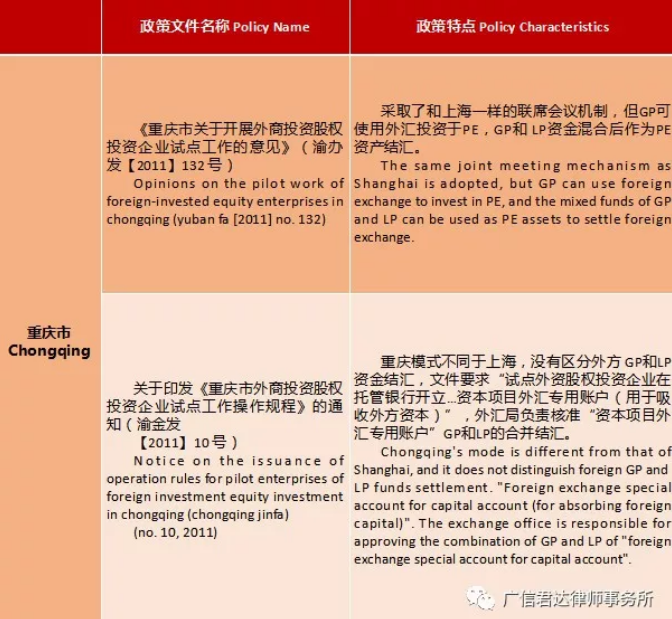

二、QFLP/ RQFLP 政策现状 / Current situation of QFLP and RQFLP policies

据不完全统计,从 2009 年到 2019年,全国有 6个省、直辖市和5个省属市出台了地方性外资私募股权投资基金支持政策,基本上集中在我国一线城市和直辖市。其中大部分地区是在几年间通过发布暂行办法、实施细则等一系列的文件,逐步形成了地方性 QFLP 政策体系(具体见表1)。各地方性QFLP 内容不尽相同,其中上海、天津、深圳相关规定可操作性较强,借鉴意义较大。总体而言,上述地区的有关政策存在以下共性。

According to incomplete statistics, from 2009 to 2019, six provinces, municipalities directly under the central government and five provincial-level cities across the country issued local policies to support foreign private equity investment funds, mainly in China's first-tier cities and municipalities directly under the central government. Most of these regions have gradually formed a local QFLP policy system by issuing a series of documents such as interim measures and implementation rules within a few years (see table 1 for details). The content of local QFLP varies from place to place, among which the relevant regulations of Shanghai, Tianjin and Shenzhen have strong operability and great reference significance. On the whole, the relevant policies in the above areas have the following commonalities.

(一)明确了 QFLP 政策的试点性质 / The pilot nature of QFLP policy is clarified.

外资 PE 在全国范围内并不普遍,因此 QFLP 政策基本上属于独立发展、一城一策。各地 QFLP 政策在具体适用区域、适用行业准入条件等方面各有侧重、各不相同。

Foreign capital PE is not common in the whole country, so QFLP policies basically develop independently, such as one city one policy. QFLP policies of different regions have different emphases and different conditions in terms of specific applicable regions and industries.

(二)明确了相关外资基金类企业的基本概念 / The basic concept of relevant foreign-funded fund enterprises is clarified.

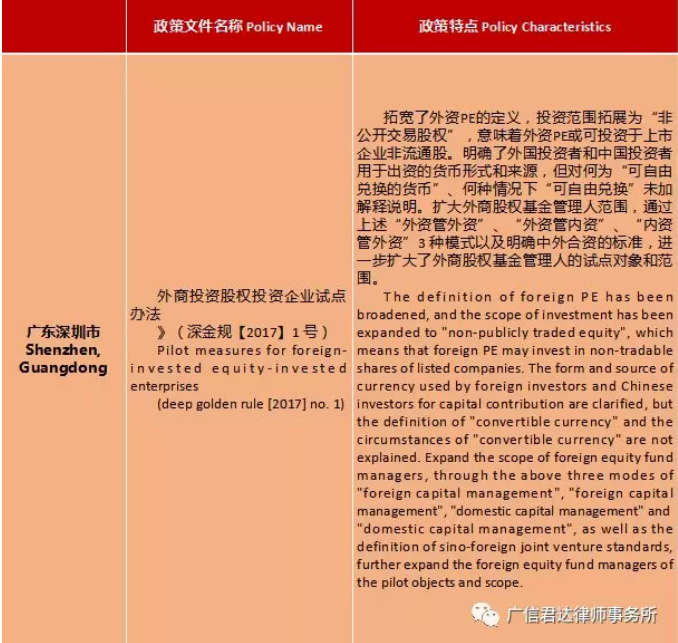

大部分地方 QFLP 政策体系中明确了“股权投资基金”和“股权投资管理企业”的概念。以最早的京金融办【2009】5号文为例,其中定义了:“股权投资基金(以下简称“股权基金”,又称 PE)是指以非公开方式向特定对象募集设立的对非上市企业进行股权投资并提供增值服务的非证券类投资基金。股权基金可以依法采取公司制、合伙制等企业组织形式。股权投资管理企业(以下简称“管理企业”)是指管理运作股权基金的企业。管理企业可以依法采取公司制、合伙制等企业组织形式。”上述概念基本上划定了基金类企业的性质、募集方式和投资(业务)范围。其后出台的文件大多参考了上述定义。直到深金规【2017】1 号才突破了PE投资于“非上市公司股权”的限定,拓展为“投资于非公开交易的企业股权的企业。”可见 QFLP政策体系中的核心概念对其政策架构的影响是深远而重大的。

In most local QFLP policy systems, the concepts of "equity investment fund" and "equity investment management enterprise" are defined. Take the earliest Beijing financial office [2009] no.5 document as an example, which defines: "equity investment fund (hereinafter referred to as" equity fund ", also known as PE) refers to the non-securities investment fund that is raised and set up from specific objects in a non-public way to invest equity in non-listed enterprises and provide value-added services. Equity funds may be organized in the form of corporations or partnerships according to law. Equity investment management enterprises (hereinafter referred to as "management enterprises") refer to enterprises that manage and operate equity funds. The management enterprise may adopt the corporate system, partnership system and other forms of enterprise organization according to law. Above - mentioned concept basically delimit the nature of fund kind enterprise, collect means and investment (business) limits. Most subsequent documents refer to the above definition. It was not until the Shenzhen financial rule [2017] No.1 that the restriction of PE investment in "equity of non-listed companies" was broken, and it was extended to "enterprises investing in equity of non-publicly traded companies". It can be seen that the core concepts in the QFLP policy system have a profound and significant impact on its policy framework.

(三)明确了该项政策的牵头单位和协同单位 / The leading unit and collaboration unit of this policy are clarified.

大部分出台QFLP政策的地区都采取了以地方金融主管单位牵头的联席会议制度,联席会议主要职责是组织有关部门制定和落实各项政策措施,负责推进外资股权投资企业试点工作,协调解决试点工作中的有关问题。

Most of the regions that have introduced QFLP policies have adopted the system of joint meetings led by local financial authorities. The joint meetings are mainly responsible for organizing relevant departments to formulate and implement various policies and measures, promoting the pilot work of foreign-invested enterprises, and coordinating and solving related problems in the pilot work.

除了上述地区采取制度先导方式外,还有一些特殊情况。例如,2016年设立在珠海横琴的广东粤澳合作发展基金,则是在没有搭建完整制度环境情况下,通过联席会议一案一议,依靠现有的制度框架办理,期间逐步破除了基金设立、出资过程中具体障碍,并在三年内完成新制度搭建。

In addition to the above areas to take the institutional leadership, there are some special circumstances. For example, the Guangdong-Macao cooperative development fund, which was established in Hengqin, Zhuhai, in 2016, was managed by relying on the existing institutional framework through joint meetings and case by case without establishing a complete institutional environment. During this period, specific obstacles in the process of fund establishment and investment were gradually removed, and the new system was completed within three years.

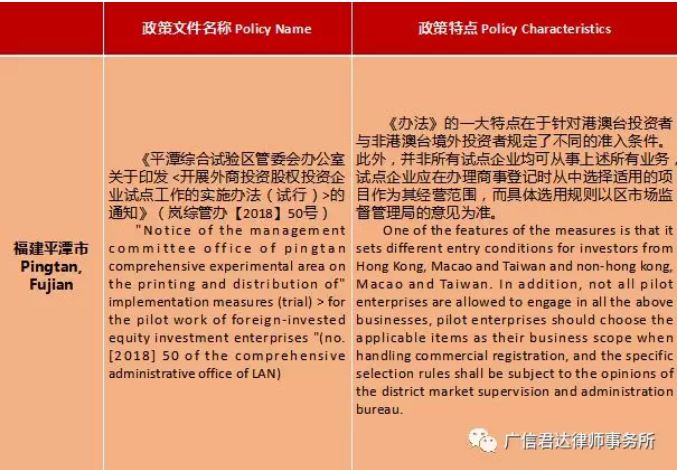

三、各地QFLP政策及特点 / Local QFLP policies and characteristics