发布时间:2022-07-04 来源于:广信君达律师事务所

自2015年6月国家税务总局、公安部联合下发《关于开展打击利用黄金交易虚开增值税专用发票违法犯罪专项行动的通知》以来,各地相关部门联合展开了打击虚开黄金增值税专用发票(下称“黄金票”)的专项行动,涌现出诸多瞩目案件。本文将结合笔者此前了解参与过的数宗合规案及相关资料分析,对“黄金票” 罪及将相关专项合规要求事先嵌入黄金等贵金属大宗交易业务的必要性作简要讨论。

一、理解“黄金票罪”

为更好理解“黄金票罪”,先要厘清“虚开增值税专用发票罪(下称“虚开专票罪”)”与“黄金交易税务风险”的概念。

“虚开专票罪”相关规定为《中华人民共和国刑法》第205条,属于侵害国家税收征收管理制度和国家税收的犯罪,指在无真实交易的情况下,虚开专票、用于骗取出口退税、抵扣税款发票的违法犯罪。犯罪对象是增值税专用发票,用于骗取出口退税、抵扣税款发票,具有抵扣并套取增值税税款的功能。

“虚开”主要有以下四种:

1. 无实际经营活动,为他人、为自己、让他人为自己、介绍他人开具专票,用于骗取出口退税、抵扣税款的其他发票;

2. 有实际经营活动,但为他人、为自己、让他人为自己、介绍他人开具数量或金额不实的专票,用于骗取出口退税、抵扣税款的其他发票;

3. 进行了实际经营活动,但让他人为自己代开专票、用于骗取出口退税、抵扣税款的其他发票;

4. 介绍他人虚开,是明知双方无真实交易而积极居间联系、撮合双方之间虚开的第三人参与介绍,该第三人一般是自然人。

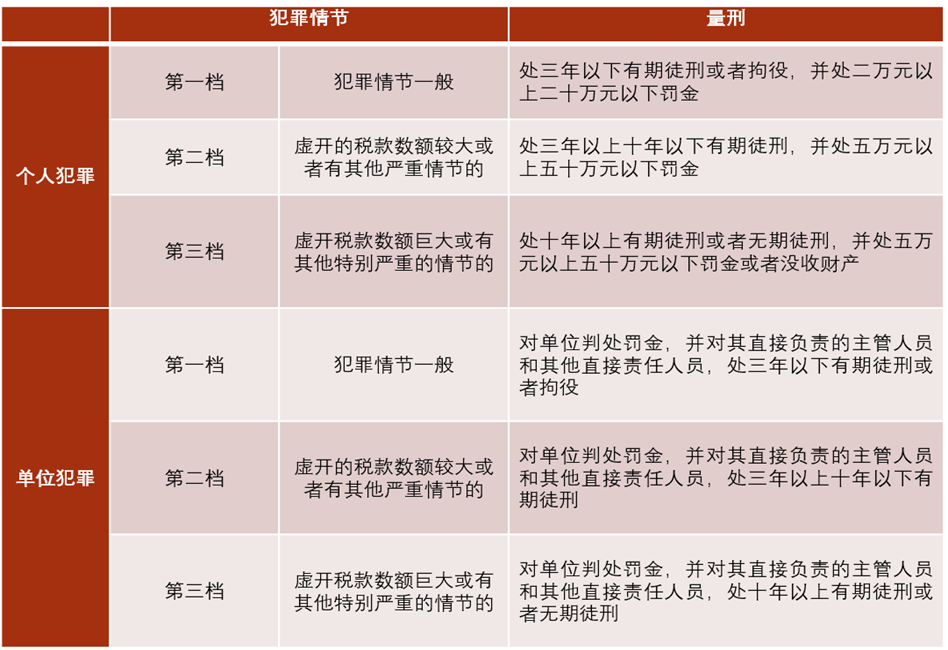

虚开专票罪的犯罪情节及量刑如下图所示:

“黄金交易税务风险”,则是指黄金作为贵金属的实物交易有金额大、票额高、体积小、流动性强的特质,实际交易活动中购金人不一定需要增值税专票,也没有取得增值税进项发票的需求。为此,黄金经销企业在经营中会积攒大量的销项发票,这些富裕下来的发票会成为“利用黄金交易虚开专票”的套利动力来源,即构成黄金交易的税务风险。

“黄金票罪”主要分两种形式:

1. 票货分离,主要是一些不法分子委托上海黄金交易所(下称“上金所”)会员单位购入黄金,取得进项发票后,通过无票售金方式对实际购金人不开票,后在无真实交易情况下向外虚开而收取抵扣的国家税收款;

2. 变造、伪造增值税专票,通过高科技手段对黄金票进行换脸,变造、伪造增值税专票上的文字信息(单位名称、货物名称等),再提供给需要进项发票抵扣的企业,进而牟取不当利益。

因上述黄金交易中的“虚”票、“假”票会引发国家增值税款损失危险,且近年曝光的黄金票罪涉案金额动辄上亿,故情节属特别严重。

二、涉案链条和分析

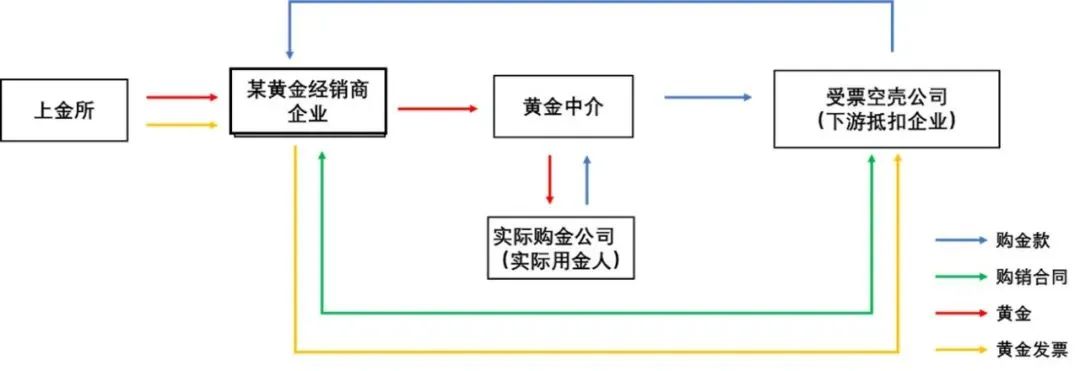

以某黄金经销企业涉嫌黄金票罪为例,涉案主体和链条包括黄金中介、某黄金经销企业、受票空壳公司、实际用金人、下游企业等。该黄金经销企业为上金所的会员单位,案发前该企业的销售黄金业务链中其他主体均由黄金中介负责联系,而该企业和黄金中介以外的其他主体没有任何直接联系。

涉嫌黄金票罪,一般交易流程为:黄金中介通过一系列第三人联系受票空壳公司,获取受票空壳公司的发票信息;实际购金公司(或称实际用金人)将购金款通过黄金中介控制的银行卡转入受票空壳公司(或称下游抵扣企业)账户,以受票空壳公司名义与该黄金经销企业签订购金合同,由下游抵扣企业将购金款转入该黄金经销企业,制作虚假资金流,虚开专票。该黄金经销企业代购黄金后,黄金中介指示其提货人冒充数十家下游抵扣企业的员工在提货委托书上签字,由实际用金人将黄金取走;黄金中介指示提货人到该黄金经销企业领取专票转交他人,从而完成票货分离。

在上述的交易环节中,该黄金经销企业及相关人员对涉案链条无全面认知,仅凭一般买卖合同关系来认为涉案业务真实存在,主观上多受到蒙蔽或放任。

三、事前事中合规

近一段时间以来,业界兴起了合规不起诉及第三方监管工作的制度热论及部分相关实践。尽管“黄金票”是虚开专票(如医药、建筑等“问题行业”)的一种特别情况,但该类案的延伸链条长(引申问题包括如何才是恰当的尽调,而非只是一般的KYC)、不同专业(如审计、法律、供应链管理等)的分工嵌入多。因此,不能只关注合规不起诉等司法事后处理机制,事前合规、事中预警亦十分必要。

笔者认为,黄金企业亦应纳入专项合规体系。在合规防御抗辩证据链体系、自愿公示及责任切割系统等合规专项逻辑体系中,亦应由独立审计师、专业律师和其他合规机构在当中综合发挥各自的专业作用。

Academic | Crime of issuing false transaction invoice and its compliance

Since China’s State Administration of Taxation and Ministry of Public Security jointly issued the Notice on Launching Special Actions against the Crime of False Issuance of Special Value-added Tax (VAT) Invoices through Gold Transactions in June 2015, relevant authorities across China have jointly taken special actions to strike down false issuance of special VAT invoices for gold transactions (the "gold transaction invoices"), leading to a number of prominent cases. This article briefly discusses the crime of issuing false gold transaction invoices and the necessity of incorporating relevant compliance requirements into the gold block and precious metal trading business in advance, with reference to available data analysis and the author's experience in relevant compliance cases.

1.Understanding the crime

To better understand the crime of issuing false gold transaction invoices, we must first grasp the concepts of "the crime of issuing false special VAT invoices (the ‘crime of false special invoice issuance’)" and "the tax risks in gold transactions". The crime of false special invoice issuance is stipulated in article 205 of Criminal Law of the People’s Republic of China as a crime violating the state tax collection and administration system and state taxation. It refers to the illegal conduct of issuing false invoices for fraudulent export tax refund and tax deduction without actual transactions being made.

There are four main scenarios of false issuance:

(1) Falsely issuing special invoices for the purpose of fraudulent export tax refund and tax deduction for others or oneself, or asking others to do so for oneself, or recommending others to do so, without any actual business operations;

(2) Falsely issuing special invoices bearing false quantities or amounts for the purpose of fraudulent export tax refund and tax deduction for others or oneself, or asking others to do so for oneself, or recommending others to do so, through actual business operations;

(3) Instructing others to falsely issue special invoices or other invoices for oneself for the purpose of fraudulent export tax refund and tax deduction, based on actual business operations;

(4) Recommending others to falsely issue special invoices or other invoices through a third party (usually a natural person) who actively mediates and brokers between the two parties to conduct such false issuance despite knowing there’s no actual transaction between the parties.

Gold being precious metal, its physical transactions are characterised by large sum, high invoice value, small volume, and great liquidity. In actual gold transactions, buyers do not necessarily require special VAT invoices, nor do they need VAT input invoices. Therefore, gold trading enterprises may accumulate a large number of sales invoices, and these surplus invoices may motivate arbitrage by "exploiting gold transactions to falsely issue special invoices", posing significant tax risks.

There are two main forms of the crime of issuing false gold transaction invoices:

(1) Separation of invoices and goods, in which lawbreakers entrust members of Shanghai Gold Exchange to purchase gold and obtain input tax invoices, and sell the gold without issuing invoices to actual buyers, then issue false invoices for the collection of national tax credits without making actual transactions;

(2) Altering or forging special VAT invoices, or altering or forging the information (e.g., name of buyers and goods) on gold transaction invoices using high-tech means for undue profits by providing such invoices to companies needing input tax invoices for tax offsetting.

Since the aforementioned false and fake invoices may lead to VAT losses of the state and reported crimes involving gold transaction invoices in recent years often amount to more than RMB100 million (USD15 million), the crime is considered particularly serious.

2.Criminal chain and analysis

Taking a certain gold transaction invoice-related crime as example, the criminal network involved the gold agency, the gold trading enterprise, an invoice receiving shell company, an actual gold user, and downstream companies. The gold trading enterprise was a member of Shanghai Gold Exchange, and the gold agency was responsible for contacting the other subjects in the gold sales business chain. The enterprise had no direct contact with any subjects other than the gold agency.

In a typical crime of issuing false gold transaction invoices, the general process is: the gold agency contacts the invoice receiving shell company through a series of third parties to obtain the invoice information of the shell company; the actual gold buyer (i.e. the actual gold user) transfers payment to the account of the shell company (i.e. the downstream company of tax deduction) via bank cards controlled by the gold agency, and enter into a gold sales contract in the name of the shell company with the enterprise who will make false record of capital flow and issue false special invoices after the purchase payment is transferred to it from the downstream company of tax deduction. After the enterprise purchases the gold, the gold agency will instruct its consignee(s) to pretend to be employees of dozens of shell companies to sign the pick-up mandates and give the gold to the actual user; the gold agency will then instruct the consignee(s) to ask for special invoices from the enterprise and give the invoices to others, thus completing the separation of invoices and goods.

In the above process, the enterprise and related persons are usually deceived or they deliberately neglect the other links, as they often have no comprehensive knowledge of all involvements and tend to believe that the transaction is real based on the gold sales contract.

3.Fore-and-aft compliance

Recent years have witnessed heated discussions and practical attempts in relation to non-prosecution and third-party supervision mechanism. Although false issuance of gold transaction invoices is merely a special situation of false issuance of special invoices (in “problematic” industries such as pharmacy and construction), the chain of crime in such cases are usually extensive (requiring consideration of due diligence issues apart from the usual KYC ones) and various professions (e.g. auditing, legal, supply chain management) may play a role. Therefore, focusing on the judicial practices such as non-prosecution is not enough. Attention must also be paid to the pre-transaction and post-transaction compliance.

The authors believe that gold transaction enterprises should strive for sound corporate compliance. Apart from leveraging compliance systems such as defense evidence proof chain, voluntary disclosure, and responsibility division, independent auditors, professional lawyers and other compliance experts should be allowed to play their indispensable parts.

作者简介

全朝晖 高级合伙人

执业证号:14401198810338104

专注领域:资本市场、金融保险及税务、跨境投融资及其多元纠纷处理机制

邮箱:qzh@etrlawfirm.com

中国政法大学法学硕士、美国法学硕士。历任执委会管委会委员及现任监事。二级律师职称,中国税务师。英国特许仲裁员协会委员、内地香港数家机构仲裁员;中国贸促会、中证资本市场法律服务中心及中证协、内地香港、新加坡、日本国际调解中心调解员;中国保险资管协会法律专委;司法部及广东律协涉外律师领军人才。

彭静 专职律师

执业证号:14401202211449927

专注领域:知识产权、证券发行、私募股权、境内外投资与并购事务

邮箱:pj@etrlawfirm.com

华南师范大学生物技术学士及获金融学双学位。曾经或正在协助处理多家境内外公司的首次公开发行股票并上市、发行公司债券、发行票据、并购重组等事务。

*声明:本站对所有原创、转载、分享的内容、陈述、观点判断均保持中立,推送文章仅供读者参考。本站发布的文章、图片等版权归作者享有,如需转载原创文章,或因部分转载作品、图片的作者来源标记有误或涉及侵权,请通过留言方式联系本站运营者。谢谢!